The 50/30/20 Budget: What It Is & Why You Need To Start Using It ASAP (+Downloadable Template)

At this point, we all know we should be following a budget. It’s the first rule of personal finance, but while it’s easy to drill into our minds, it’s a little harder to put into practice. Enter: the 50/30/20 budget rule. This is a simple, easy-to-implement rule that leaves you with guaranteed savings at the end of the day, which is precisely why I love and recommend it to so many of my friends.

What is the 50/30/20 budget rule?

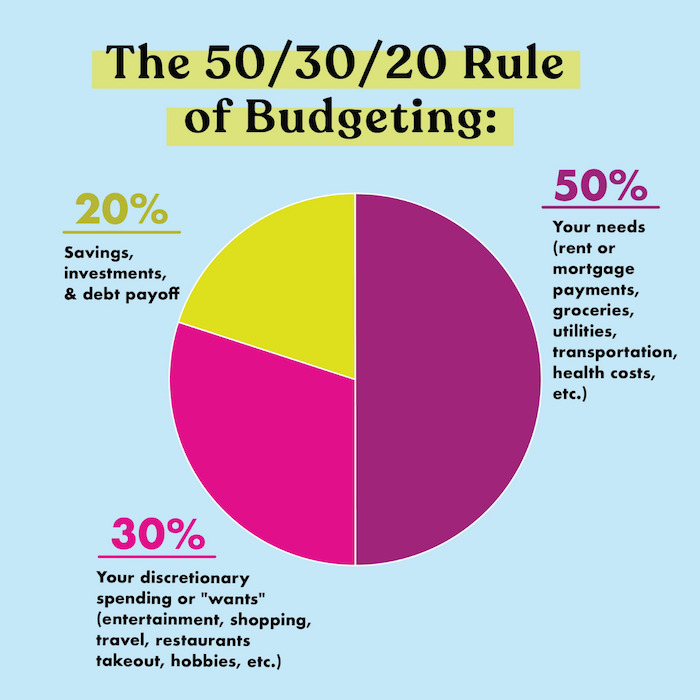

The 50/30/20 budgeting technique breaks down your necessary expenses, leisure expenses, and savings into percentage categories of your salary. So, 50% of your salary should go towards necessities—think rent (or mortgage payments), private or public transportation to or from the office (or car insurance and garage parking for your vehicle), necessary groceries (so the bare minimum you need, not the fancy seaweed you splurge on), utilities, and debt.

Then, 20% of your salary should go towards savings. This includes retirement accounts like a 401(k) or an IRA as well as an emergency savings fund or investment accounts. You decide how to divvy up this 20%. If your company offers a 401(k) match on 5% of your salary, for example, you may put 5% into your retirement account, 5% into an investment account, and another 10% into an emergency savings fund. It’s entirely your choice, but 20% must be saved.

“Essentially, this is guilt-free spending and this 30% is entirely for you.”

Finally, 30% of your salary is for leisure spending. So, this is the portion of your grocery bill that would go towards wine or the part of your salary that you set aside to eat out at restaurants, travel, and buy that $5 latte. Essentially, this is guilt-free spending and this 30% is entirely for you. This includes a gym membership, a car upgrade, furniture for your apartment (outside of a bed or kitchen essentials), therapy, hobbies, the GRE, etc.

Why use the 50/30/20 budget rule?

For me, the 50/30/20 budget rule is a simple technique that guarantees that I’m saving 20% of my paycheck and must live within a certain means without being too restrictive. If my rent, transportation, utilities, groceries, and loan payments exceed 50% of my paycheck then I need to either (1) consider getting a lucrative side hustle to grow my total salary in a meaningful way (or negotiate a raise!) or (2) reduce my “necessary” payments by auditing my spending. This may include downsizing my apartment to pay less rent or owning a cheaper car. This rule is adaptable to your location since it operates on a percent of your salary base so I can stick to this same budgeting technique even if I moved across the country.

Most importantly, it allows me to spend 30% of my salary guilt-free. I already know where the remaining 70% of my salary is going so I can use the rest to enrich my life and actually live, not merely save every penny. In a society that berates us for buying a $5 latte while failing to equip us with investment knowledge that can actually enable our wealth to grow, it’s so important to spend money on yourself, whether it’s your physical health (a gym membership, nourishing meals at a restaurant with friends, traveling to beautiful destinations), mental health (therapy, a luxurious spa day), or emotional health (a best friend’s wedding, visiting family).

“In a society that berates us for buying a $5 latte while failing to equip us with investment knowledge that can actually enable our wealth to grow, it’s so important to spend money on yourself.”

This rule is best for people who want to make savings a priority—genuinely setting aside money into an IRA or retirement account in addition to a savings account every month—and have minimal debt. When I was paying off my student loans, it was (personally) tough to justify spending 30% of my salary on leisure and keeping my debt payments to the 50% of my salary that included necessities. Still, what I like about this rule is that you can easily adjust it, saving 30% of your salary in a particular month and cutting down leisure spending to just 20%, instead, contributing more of your salary to your loan payments. No budgeting technique is set in stone but this is an easier one to adapt and adjust than others.

How to actually use the 50/30/20 budget rule

Here is a sample TFD 50/30/20 template, that you can download here!

I highly recommend tracking your money at all times, but if you specifically follow 50/30/20, here are some tips on how to track and calculate your spending.

Suppose I take home $5000 net a month (aka the money I take home after tax deductions). Then, using the 50/30/20 budget rule, $2,500 of my monthly salary would go towards necessities, $1,500 towards leisure spending, and the remaining $1,000 towards savings.

For necessities (50%), I subtract my monthly rent, utilities, and transportation payments (typically $2,150 total) to arrive at my grocery budget for the month ($350). I then divvy-up that amount for my groceries per week, which is typically around $85/week.

For savings (20%), I typically automate 5% of my salary to investments, another 5% to retirement, and 10% into my emergency savings fund which is in a high-yield savings account.

Finally, I subtract my monthly recurring leisure spending (30%) from the $1,500 I have allotted for the month. For me, this includes a gym membership, bi-weekly therapy appointments, Netflix and Spotify subscriptions, and $150 which I contribute to a travel savings fund (right now saving for a friend’s destination wedding). The remaining amount I then divide among each week to arrive at my weekly leisure spending for restaurants, hikes, happy hours, or shopping.

By having an Excel spreadsheet that automatically calculates your recurring monthly expenses (rent, gym, etc.) and then allots those expenditures into the correct category, you can arrive at the remaining amount you have to spend within each category per week. For me, I like having a weekly grocery or restaurant budget to work off of but if a monthly, or bi-weekly, budget works best for you, you can adapt your budget accordingly.

If you need help figuring out if this budget method is right for you, or how to get started, I highly recommend kicking off with a 50/30/20 calculator, which you can find here.

Keertana Anandraj is a recent college grad living in San Francisco. When she isn’t conducting international macroeconomic research at her day job, you can find her in the spin room or planning her next adventure.

Image via Unsplash